knoxville tn sales tax rate 2020

The Knoxville sales tax rate is. Knoxville Tn Vehicle Sales Tax.

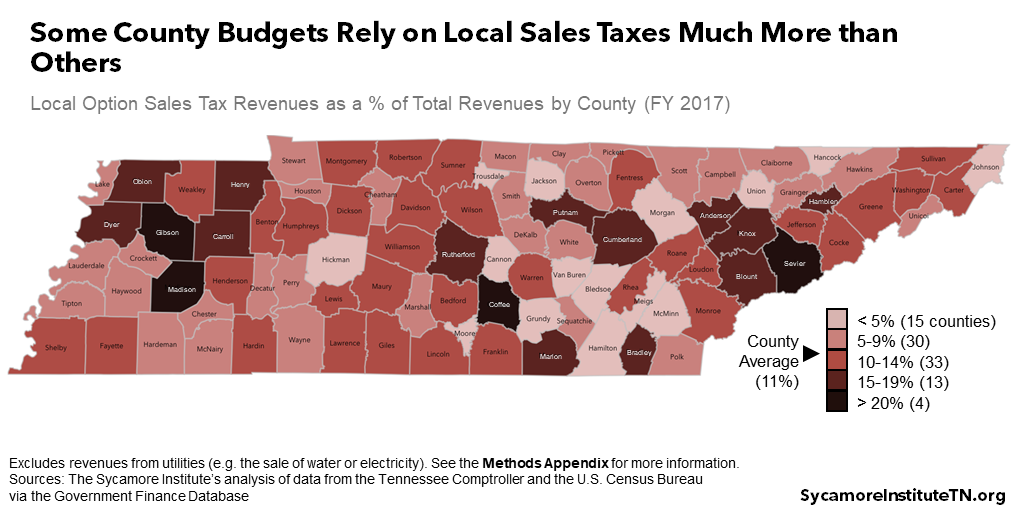

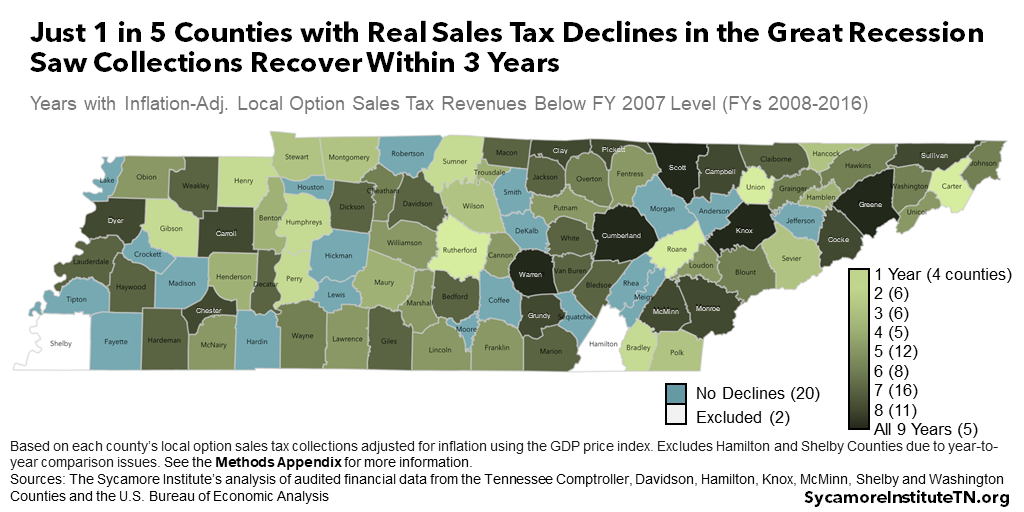

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

All local jurisdictions in Tennessee have a local sales and use tax rate.

. The local sales tax rate and use tax rate are the same rate. The Tennessee sales tax rate is currently. This rate includes any state county city and local sales taxes.

Knoxville budget holds the line on spending and taxes amid COVID-19 crisis. Knox County Tennessee has a maximum sales tax rate of 975 and an approximate population of. The general state tax rate is 7.

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. The current total local sales tax rate in knoxville tn is 9250. March 2 2022.

The Tennessee sales tax rate is currently 7. The Knox County sales tax rate is. For purchases in excess of 1600 an additional state tax of 275 is added up to a.

The Tennessee state sales tax rate is currently. Restaurants In Erie County Lawsuit. There is no applicable city tax or special tax.

The minimum combined 2022 sales tax rate for Knoxville Alabama is. The local tax rate varies by county andor city. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Majestic Life Church Service Times. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The local tax rate may not be higher than 275 and must be a multiple of 25.

Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250. This tax is generally applied to the retail sales of any business organization or person engaged. The December 2020 total local sales tax rate was also 9250.

The combined rate used in this calculator 925 is the result of the tennessee state. This is the total of state and county sales tax rates. The december 2020 total local sales tax rate was also 9250.

2020 rates included for use while preparing your income tax deduction. Food in Tennesse is taxed at 5000 plus any local taxes. With local taxes the total sales tax rate is between 8500 and 9750.

What is the sales tax rate in Knox County. None 1 flat tax on interest and dividends earned in tax year 2020 sales tax. This is the total of state county and city sales tax rates.

The state general sales tax rate of Tennessee is 7. The County sales tax rate is 225. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax.

The County sales tax rate is. Are Dental Implants Tax Deductible In Ireland. Income Tax Rate Indonesia.

Comptroller of the Treasury Jason E. Soldier For Life Fort Campbell. The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925.

The sales tax is comprised of two parts a state portion and a local portion. Taxpayers over 65 with total income less than 16200 for a single filer or 27000. Sales or Use Tax Tenn.

Restaurants In Matthews Nc That Deliver. This amount is never to exceed 3600. Loss of 8 million to 9 million in sales tax revenue spread across the end of the 2019-20 and beginning of the 2020.

Average Sales Tax With Local. Purchases in excess of 1600 an additional state tax of 275 is added up to a. The Knoxville sales tax rate is.

Please click on the links to the left for more information. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Submit a report online here or call the toll-free hotline at 18002325454.

Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. Sales Tax Calculator Knoxville Tn DTAXC. State Sales Tax is 7 of purchase price less total value of trade in.

The Alabama sales tax rate is currently. Local Sales Tax is 225 of the first 1600. The Knox County Sales Tax is collected by the merchant.

05 lower than the maximum sales tax in TN. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. The 2018 United States Supreme Court decision in South Dakota v.

31 rows The state sales tax rate in Tennessee is 7000. Local collection fee is 1. Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes.

The minimum combined 2022 sales tax rate for Knox County Tennessee is. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. You can print a 925 sales tax table here.

Tennessee has state sales. The latest sales tax rate for Maynardville TN. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments.

Local collection fee is 1. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Tennessee has recent rate changes Fri Jan 01 2021.

County Property Tax Rate. This is the total of state county and city sales tax rates. The 2020 model gets an impressive 14MPG in the city and 23MPG on the highway.

Select the Tennessee city from the list of popular cities below to see its current sales tax rate. This amount is never to exceed 3600.

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee Car Sales Tax Everything You Need To Know

Historical Tennessee Tax Policy Information Ballotpedia

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

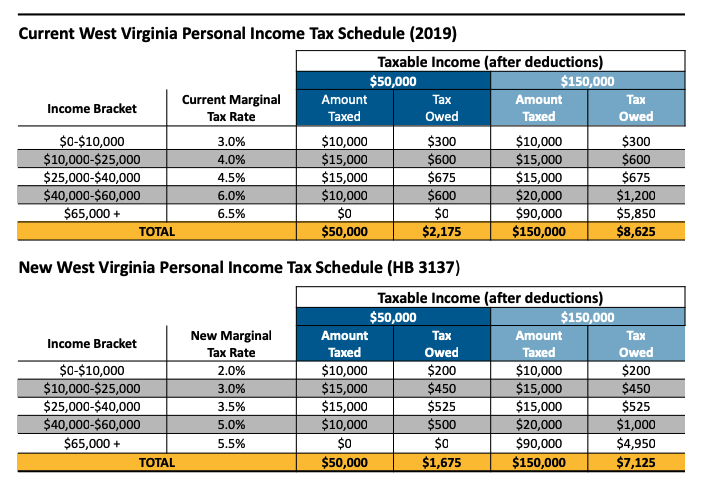

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Texas Sales Tax Rates By City County 2022

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Ohio Sales Tax Rates By City County 2022

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Sales Tax On Grocery Items Taxjar

Alabama Sales Tax Rates By City County 2022

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue